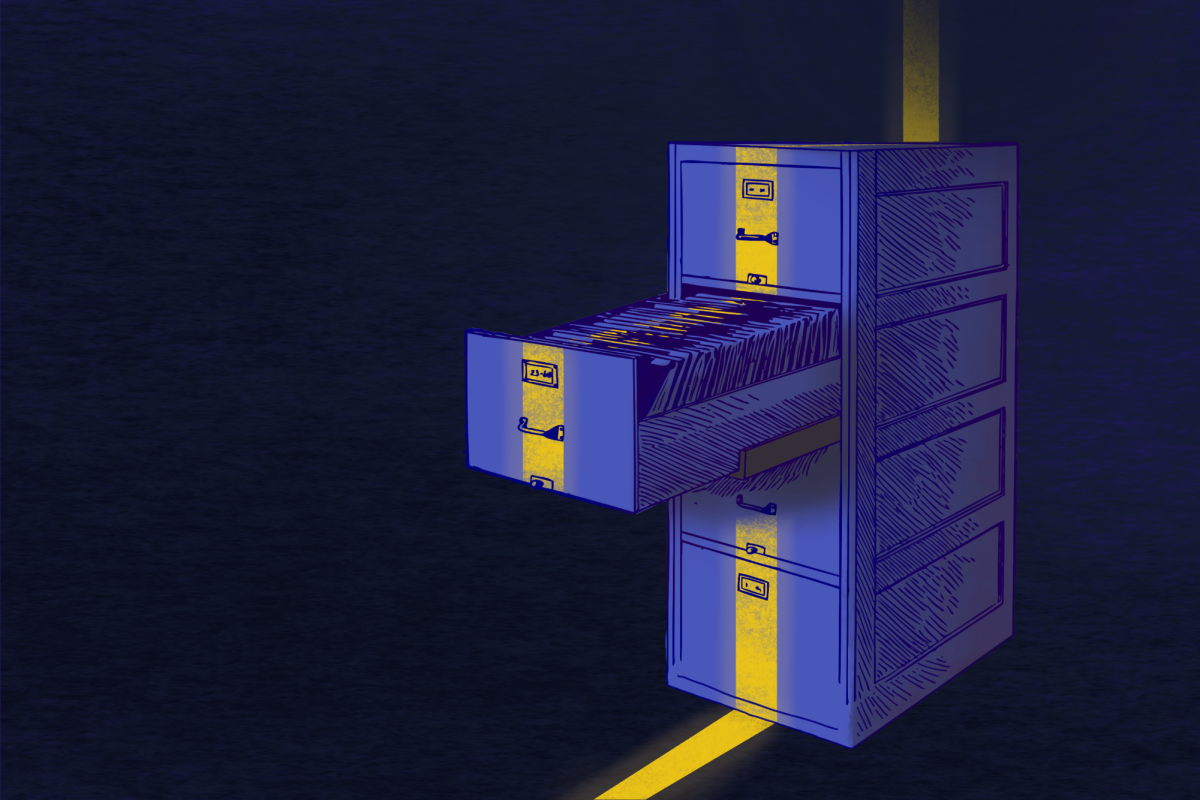

It’s a service we can’t opt-out of, 143 million identities were compromised, now what?

By Dejon Gill

Equifax, a consumer credit reporting agency, was hacked between May and July of 2017. This means that the Social Security numbers, addresses, and other personal information of over 143 million American consumers is now in the hands of hackers.

Equifax, Experian, and TransUnion are the three credit reporting agencies that track consumer credit ratings, which are used to determine everything from loan eligibility to hiring decisions.

We consumers cannot opt-out of this service. From the time that we open our first bank account, get our first job, or otherwise engage in the economy, the credit agencies begin tracking our behavior to determine our credit scores. Even choosing to not participate in the economy affects our credit scores.

According to the Social Security Administration’s website, an individual can change their social security number if, among other reasons, “A victim of identity theft continues to be disadvantaged by using the original number.” However, the process is not easy, and even then, the activity on the new number will be cross-referenced with activity on the old number. This means that victims of identity theft will have to continually prove that they did not make purchases made by the identity thieves.

The response from the company as well as our lawmakers has been insufficient.

—

The security breach at Equifax shows that greater consumer protections are needed when the vast majority of consumers are affected by a company, especially for services which consumers are automatically enrolled with no choice to opt-out.

We should all be monitoring our credit, more so now that due to this Equifax hack; the data of over 143 million consumers have been definitely compromised. The response from the company as well as from our lawmakers has been insufficient.

As anyone who has had or knows someone who has had their identity stolen, the burden of proof lies on the victim, and the process can take years. Consumers were not responsible for this breach in security, and should not be the ones held responsible, yet we are the ones who will repeatedly be held responsible.

To find out if your information has been compromised, visit: https://www.equifaxsecurity2017.com/am-i-impacted/

Dejon Gill is a Tower Staff Writer. Email him at dejonjgill(at)gmail.com.