By Michelle Snider

Students across California are organizing to pass a tuition funding bill for all state residents.

Attorney General of California Xavier Becerra received the “College for All Act of California,” drafted by college students and their supporters, October 11, 2017.

If this act passes it will provide grants to all California undergraduate students in attendance at a public college.

It would cover tuition and include a stipend for living expenses and supplies.

If accepted as a ballot measure and voted into law in the midterm elections, the bill will take effect January 1, 2019.

Students involved in the initiative are scrambling for the 800,000 signatures they need by April 24 in order to get the act on the November ballot. There are an estimated 200,000 signatures so far.

Laney College student Amado Canham says the fight will not stop if the 800,000 signatures are not obtained by the deadline.

“The struggle for low-income people does not stop at this ballot,” he said. “We are going to continue the fight for better education.”

Cynthia Diaz, a student at City College of San Francisco, says there are two parts to College for All. Besides getting all the signatures turned in by the April 24 due date, they are also focusing on the long-term effort for student organizing.

“We are trying to build a student movement… because tuition is too costly for working-class students,” she said.

Diaz also explained how organizing with College for All California is an opportunity to learn about politics while tackling underlying problems.

“We are building with student organizations to understand why we are struggling to pay for school in the first place,” she said, “and getting their perspective on what issues are more prevalent on their campus.”

The measure will raise approximately $4 billion in new revenue, dedicated entirely to student aid, through the California Estate Tax. Low-income students would get an 80 percent increase in state aid for non-tuition living expense costs, according to the College for All website.

The estate tax is a tax on property transferred from the deceased to their heirs. The website states that this tax affects the wealthiest 0.2 percent of Californians.

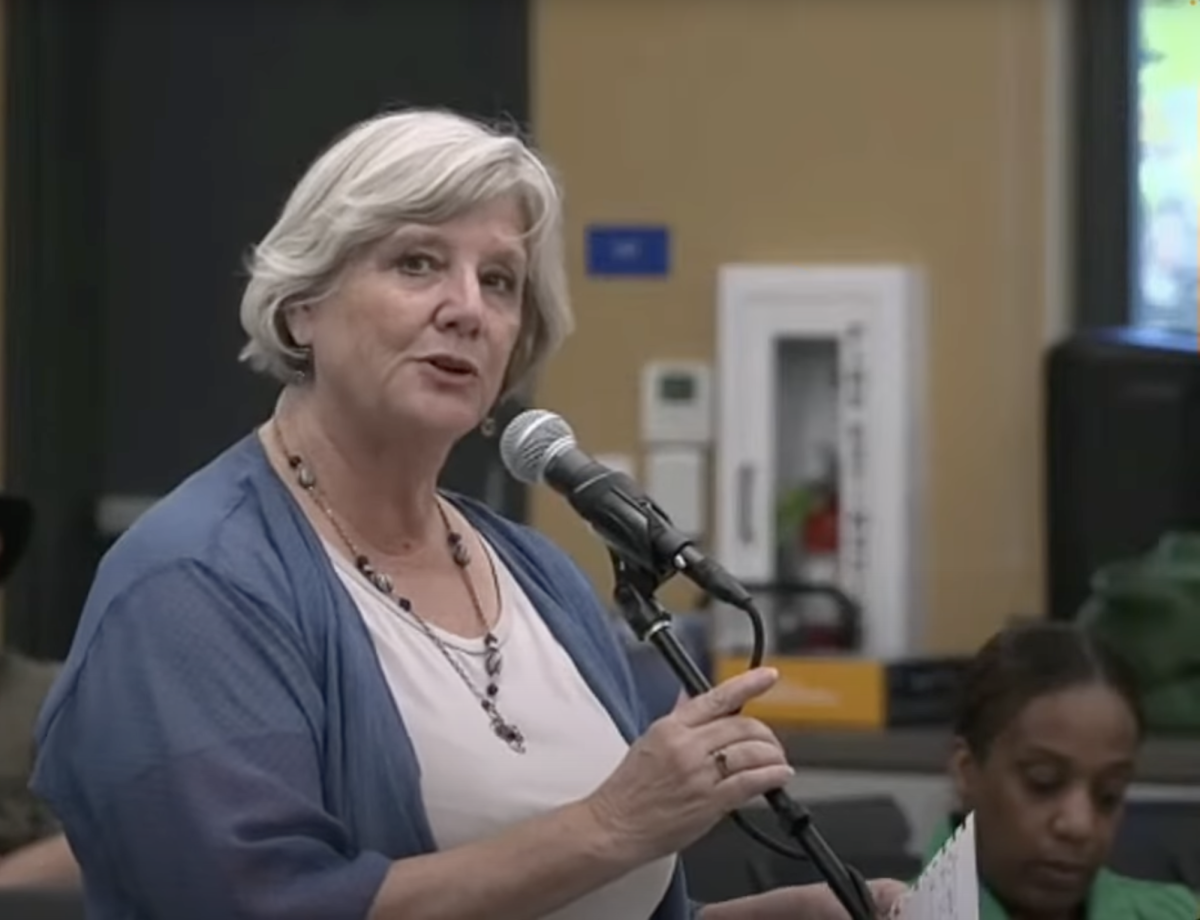

CCSF student Alvarado Gonzalez said in a presentation to Peralta district regular board of trustees meeting on March 27 the tax increase would be 11 percent for individuals who receive $3.5 million or above, and 22 percent for married couples who receive $7 million or more in inheritance.

According to a presentation on the website, in 1978 a bill was passed called Proposition 13, which gutted property taxes by 57 percent, thereby slashing $3 billion in funding for public education.

Eligibility for Cal Grants currently excludes more than 330,000 working class students who failed to attend college directly from high school. An expansion on the eligibility would help many formerly incarcerated students.

The measure will offer more aid to undocumented students considered residents under AB130.

For more information, visit www.collegeforallCA.com. Laney students can sign the petition in the Umoja-UBAKA Student Success Community next to the Laney Garden in Eagle Village #2.

Michelle Snider is a Tower staff writer