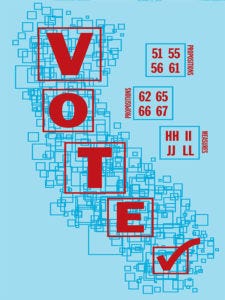

From parole to pot, from plastic bags to prescription drugs, the bay prepares to cast their ballots in a historic election. The Laney Tower’s guide to measures and propositions.

In the Laney Tower’s final issue before the Nov. 8 election, the Tower staff offers its readers a comprehensive election guide that looks at many measures and propositions on the ballot next month.

From prescription drugs to parole, from pot to plastic bags, many of the issues that these measures and propositions tackle will have long-lasting effects on students, teachers, staff members, and the community at large.

At the Tower, we believe that by helping voters break the issues down, we can make it easier for people to make informed decisions about these propositions.

However, the Tower is not making any recommendations on how to vote, nor are we endorsing any candidates. Under state law, and pursuant to Peralta Community College District Board Policy, we are prohibited from making any such recommendations or endorsements.

However, we feel obligated to urge every one of our readers to go to their polling places on Nov. 8 and vote. Since we are all part of the same Bay Area community, as well as the nation, we all have a stake in the election’s results.

After all, when voter turnout is low, the status quo usually remains in effect.

We would like to encourage all Peralta students to make your voices heard and your interests representeed, not only by voting, by also by fighting on every other day of the year for the rights we need and are often denied.

Voting is one of those rights, as well as a responsibility. Even today, there are places in this country where citizens are disenfranchised. Exercise your right! Please vote on Nov. 8, 2016.

Educational facilities

PROPOSITION 51

Proposition 51 is the Kindergarten Through Community College Public Education Facilities Bond Act of 2016.

Prop 51 proposes a bond of $9 billion to fund the facilities of elementary schools through community colleges. $3 billion would be allotted for new construction in K-12 schools, as well as another $3 billion for renovation of existing K-12 schools. $1 billion would provide funding for the facilities in charter and vocational schools, and $2 billion for community colleges.

In order to pay off the $9 billion in bonds and $8.6 billion in interest, the state will pay around $500 million a year for 35 years.

Proponents of Prop 51 argue that the facilities of California K-14 schools are in dire need of renovation and in some cases reconstruction, and that the 89.3 million students enrolled in these schools deserve the right to facilities that are safe and well functioning. Opponents say that Prop 51 is unaffordable and that the schools system has already received plenty of funding for renovation and the proposition does nothing to correct the “one-size fits all” nature of the education bureaucracy.

BY WESLEY HRUBES

Income tax and sales tax

PROPOSITION 55

Voting yes on Proposition 55 would prevent the current tax structure from expiring.

In 2012, voters approved a higher, temporary tax on California residents making more than $250,000 per year. Money from this tax provides about $7 billion for the state each year.

The tax is scheduled to expire at the end of 2018. There was a temporary increase in the sales tax which expires at the end of 2016.

Proposition 55 ensures that the 2012 income tax increase would be extended until the end of 2030. The money collected from these taxes would provide more money for schools and community colleges.

Proposition 55 would also provide extra money to the Medi-Cal health care program in some years. The temporary increase in the sales tax would expire.

Proponents say Proposition 55 would provide billions of dollars for schools and community colleges. Opponents say the state should respect voters’ decision from 2012 and that it will hurt small businesses and eliminate jobs. It will also take money away from people who have worked hard to earn it.

COURTESY OF VOTER’S EDGE

Tobacco tax

PROPOSITION 56

Proposition 56 is a proposed tax on all tobacco purchases. If it passes, there will be an additional $2 tax on every pack of cigarettes sold in California, on top of the 76 cents taxed currently.

Revenues from these new taxes would primarily be used to fund the California Healthcare, Research and Prevention Tobacco Tax Act of 2016 Fund, allocating monies to health-care for low income Californians, smoking education, research into smoking related disease, and University of California Physician programs.

Proponents include most major health-care providers and also many doctors, who argue the tax is about fairness because the State of California has a current tax burden of subsidising healthcare for citizens with tobacco related diseases, since smoking is one of the most deadly preventable causes of terminal illness.

Opponents include the California Republican Party and the Tobacco Lobby. They claim the law would be a “tax-hike grab” by health insurance companies who would largely benefit from the revenues of the tax, and criticize that it budgets $147 million of revenues each year for administrative/bureaucratic costs.

BY WESLEY HRUBES

“voting is the foundation stone for political action.” Martin Luther King jr.

Prescription drugs

PROPOSITION 61

Proposition 61 would limit the amount of money state agencies could pay for prescription drugs to the same amount that the Veterans Administration (VA) pays.

The VA pays about 42 percent of market value for its prescription drugs. This law would not affect the price individuals pay for their prescriptions. The Democratic Party, Sen. Bernie Sanders, AARP, and the California Nurses Association support it and argue it will save taxpayers an estimated $1 billion dollars a year.

Opponents include the Republican Party, Johnson & Johnson, Bristol-Meyers Squibb Company, Purdue Pharma, and many veterans groups. The top ten donors to the No on 61 campaign are pharmaceutical companies.

Opponents claim the proposition would raise drug prices for veterans.

Former Chairman of the Senate Veterans’ Affairs Committee Bernie Sanders says “pharmaceutical companies cannot unilaterally raise the prices of drugs they sell to the VA.”

Opponents also argue that the proposition would only help a small number of Californians.

BY BONNIE OVIATT

The death penalty: end of the line or fast track?

PROPOSITION 62

Proposition 62 states that criminals eligible for the death penalty should instead be sentenced to a lifetime in prison with no likelihood of parole.

Under current law, some prisoners convicted of first-degree murder may be sentenced to death. California has not executed a prisoner since 2006. There are 748 prisoners currently waiting to be executed on “death row.” Almost all are involved in appeals to their death sentences, with multiple court proceedings after their original conviction.

If the proposition passes, the death penalty would be eliminated. The maximum penalty for first-degree murder would be life in prison without the possibility of parole.

All prisoners convicted of murder, including those serving life in prison, would be required to work. The amount of money that could be deducted from inmates’ pay would also increase from 50 to 60 percent. This money would be used to pay any debts owed to victims and their families.

Opponents say the state needs the strongest possible punishment for the most serious first-degree murderers, and that the pay that inmates would put toward victims’ families cannot make up for the lost life. Individuals who vote no believe the death penalty should remain as is.

PROPOSITION 66

Proposition 66 is the Death Penalty Reform and Savings Act of 2016. It says that the death penalty needs improvement in regards to the time limits for executions.

The objective is to limit the time frame in which death sentences can be appealed to a maximum of five years.

Prisoners sentenced to death may fight the sentence before the California Supreme Court and then the federal courts. This process can take multiple decades and cost the state millions of dollars. Of the 930 people who have received a death sentence since 1978, 15 have been executed and 103 have died while waiting to be executed. Under current law, inmates sentenced to death must be housed at specific prisons. Proponents say the appeals process for death row inmates needs to be quicker and less complicated.

Opponents say Proposition 66 would cost taxpayers tens of millions of dollars in legal and lawyer fees.

COURTESY OF VOTER’S EDGE

ADDITIONAL REPORTING BY ALEXANDRA EVANS

Legalizing marijuana

PROPOSITION 64

The Adult Use of Marijuana Act (Proposition 64) would legalize the recreational use of marijuana (cannabis) for adults over 21. Voting “yes” would also establish regulation of the industry, including taxes and business standards.

The estimated $1 billion in state tax revenue is specified within Prop. 64 to fund its regulatory committee, law enforcement training, youth programs, environmental clean-up, and other public programs.

It would still be illegal to sell to minors, illegal to drive under the influence, and illegal to export outside of state borders.

The proposition also involves five-year waiting period for large cultivation licenses. Companies with tobacco licenses would not be allowed to also have a cannabis license. No out-of-state commerce would be allowed; federal law would still prohibit advertisements for marijuana on TV.

Opponents argue it opens the floodgates for large corporations to dominate and monopolize the industry. Proponents note that the excessive number of marijuana-related arrests of Black and Latino in Oakland alone demand immediate decriminalization.

BY SARAH CARPENTER

Plastic bags: should they stay or should they go?

PROPOSITION 67

Proposition 67 would enact a statewide ban on single-use plastic bags.

In 2014, the Legislature passed a law that banned single-use plastic bags throughout California but that law never went into effect statewide. Voting “yes” on Prop 67 would allow that law to go into effect. If Proposition 67 passed single-use plastic bags would not be allowed at grocery stores, convenience stores, large pharmacies, or liquor stores.

These stores would be required to charge for paper or thicker plastic carry-out bags, and they would get to keep the money.

Proponents of Prop 67 say that single-use plastic bags are bad for the environment and harmful to wildlife, and that thus it would protects animal and save the state millions of dollars in clean-up costs.

PROPOSITION 65

Proposition 65 also involves plastic bags, but voting “no” would prevent that ban from going into effect across the state.

Proposition 65 was written and financed by the plastic bag industry in order to challenge Proposition 67. The plastic bag industry has spent $9,054,085 to pass Proposition 65 and defeat Proposition 67.

Some backers of Proposition 65 claim it would help the environment. However, no prominent environmentalists or environmental groups have come out in support of Proposition 65.

CAMPAIGN FUNDING

No on Prop 67

$2,886,883 from the plastic bag industry. Top donors: Hilex Poly Co. LLC ($2,783,739); Superbag Corp. ($1,238,188); Formosa Plastics Corporation U.S.A., ($1,148,442); Advance Polybag, Inc. ($946,833); Durabag Co., Inc. ($50,000.00).

Yes on Prop 65

$6,167,202 total, from the plastic bag industry. Top donors: Hilex Poly Co LLC ($1,082,239), Formosa Plastics ($748,442); Superbag ($609,370); Advance Polybag ($446,833).

Yes on Prop 67

$1,645,561 from grocers and environmentalists.

Top donors: Safeway ($150,000); California Grocers Association ($112,000); environmental activist Claire Perry ($100,000); Ralph’s ($80,000); Save The Bay, a 501c non-profit ($50,000)

BY ALICE FELLER

“the ballot is stronger than the bullet.” Abraham Lincoln

Taxing sugary drinks

Measure hh

Oakland’s Measure HH proposes to tax distributors of sugary drinks one cent per ounce.

The revenue will be used for healthcare and health education programs. It is supported by the American Diabetes Association, the American Heart Association and the Coalition for Healthy Oakland Children.

Opponents, which include the American Beverage Association (ABA), say this proposition actually taxes distributors, who will pass the cost onto businesses who will pass the cost on to pass on consumers, resulting in higher food and grocery costs.

A similar tax in Berkeley came on the heels of a Sept. 2009 New England Journal of Medicine (NEJM) study that connected the consumption of sugary beverages to the rise in health problems and health care costs.

In Berkeley, the tax resulted in lower health problems and costs to the public. Since 2014, that city has raised $1.4 million per year for nutrition and health education programs.

As of press time, no opposing viewpoints were available.

BY ALISON STAPP

Lease terms on property

Measure ii

Measure II proposes an “increase in the maximum lease term on city-owned property from 66 to 99 years,” according to the League of Women Voters of Oakland.

This measure is intended to help affordable housing stay and thrive in the city for a longer period of time.

The positives include long-term affordable housing, less community- member turnover, and less constant displacement by long-term Oakland residents.

Through this, the city’s at-risk community members could have long-term affordable housing, while playing a role against the current effects of constant community member displacement in the city.

Currently, there is little idea of the economic impact on the city. In many ways, the city could benefit from a more stable and involved community population that is not under immediate threat of being forced out.

BY LAUREN JELKS

Rent hikes and evictions

MEASURE JJ

Measure JJ works to fix issues of rent hikes and evictions by increasing city oversight for landowner and tenant relations.

Property owners must submit reports regarding rent hikes and evictions to the city for approval, while the Just Cause and Rent Adjustment Ordinance will be amended.

The goal of this measure is to help Oakland, the fourth most expensive housing market in the country, combat the effects of rising rental prices.

Pros include more stable housing situations for current renters, facilitating more City Hall involvement in the community, and slowing the effects of displacement that long-term citizens have been forced to deal with.

According to the “Protect Oakland Renters” organization, Measure JJ will not impact owners with fewer than three units, will be fair to owners as a whole, and is one step of many to slow the effects of gentrification in Oakland.

BY LAUREN JELKS

Police oversight

MEASURE LL

Measure LL would establish two organizations for civilian oversight of police in Oakland: the Police Commission, and the Community Police Review Agency.

The commission would include nine members (four appointed by the Mayor). The group would review reports from the police chief, removing a chief for cause, and compiling the list of candidates for any new chief appointed. The mayor would select from their list of four candidates.

The Community Police Review Agency would consist of one investigative agent per every 100 sworn police officers.

It would be responsible for investigating claims of police misconduct. It would also report its findings and proposed discipline to both the commission and the police chief.

BY SARAH CARPENTER