Credit rating agency Fitch Ratings downgraded its rating of the Peralta Community College District (PCCD)’s financial outlook in a 2024 annual report, due to concerns over the district’s projected funding, managerial turnover and declining enrollment.

“The district must find ways to retain and attract new students which could be greatly challenged if the district must make cuts to service levels to align increasing expenditures with plateauing revenue,” the Sep. 20 report states.

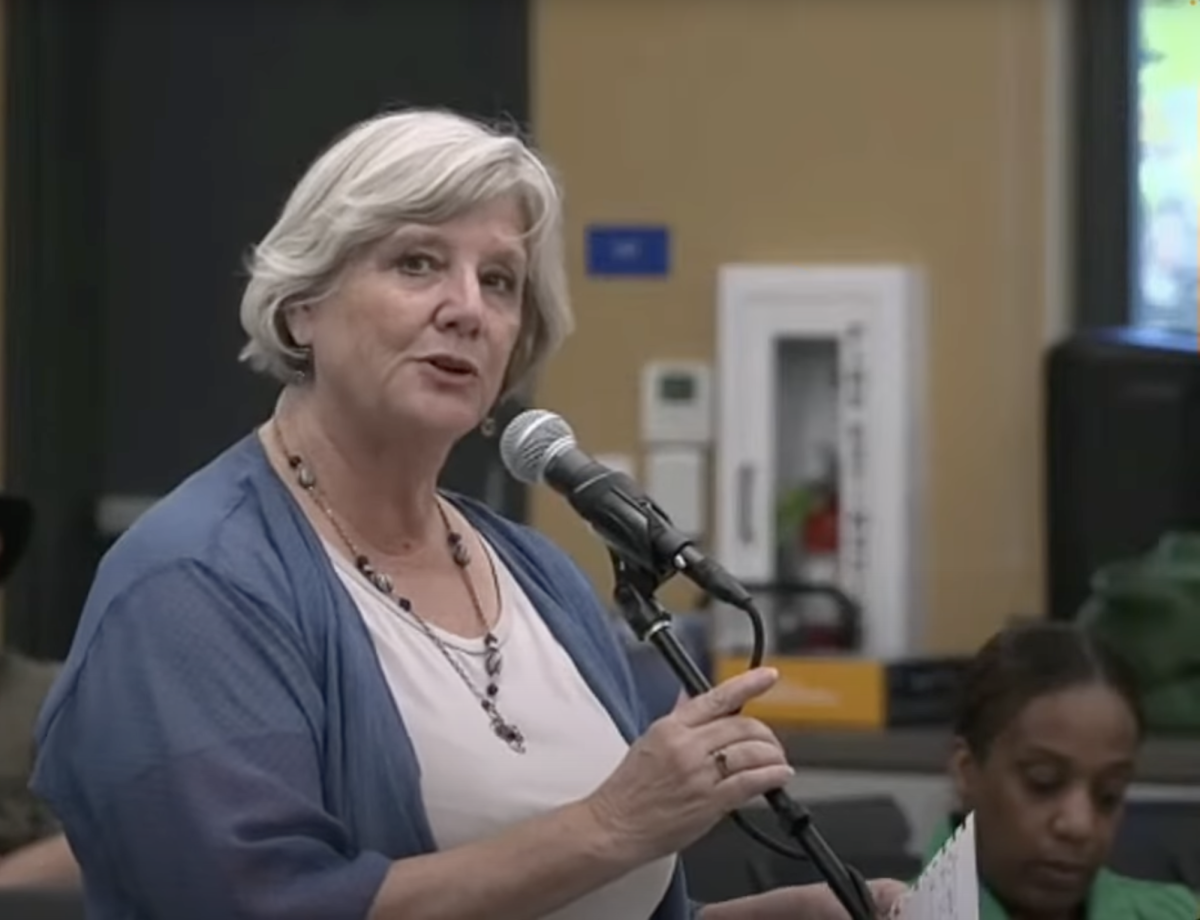

The report also expresses concern over PCCD’s “continued management turnover,” citing the appointments of a new Chancellor and Chief Operating Officer (COO) in 2024.

The COO position was recently restructured to fold in the responsibilities of the Vice Chancellor of General Services and Vice Chancellor of Finance and Administration.

Fitch reaffirmed Peralta’s individual bonds’ respective “AAA” and “AA-” ratings. Fitch’s rating scale ranges from AAA to D. An “AA” rating indicates “very high credit quality,” according to Fitch’s website.

The bond’s holders would likely continue to receive payment if the district declares bankruptcy, according to “legal opinions by district counsel” cited in the report.

PCCD’s financial outlook was upgraded to “stable” two years ago. Before 2022, Fitch’s view of the district’s outlook had remained “negative” for nine straight years.

Fitch’s outlook rating reflects the amount of financial pressure Peralta is projected to face over the next three years, based on PCCD’s new reduced budget. The district anticipates continued increasing expenses, as well as stagnant revenue, until enrollment increases.

In an interview, Fitch Ratings analyst Graham Schnaars explained that while the change in outlook would not have an effect on PCCD’s existing bonds, it could increase interest rates for any new bonds the district issues.

He added that there’s not yet enough financial pressure to lower the ratings on any of the bonds, citing the district’s planned expenditure cuts.

The district anticipates minimal current effect on Peralta community members, according to Greg Nelson, PCCD’s Deputy Chancellor and Chief Operating Officer.

“The impact on the local taxpayer is small and will not be realized until we sell a new round of bonds on the open municipal market,” Nelson said.

PCCD’s other two primary credit rating agencies are Moody’s and Standard & Poor. According to Nelson, the district is only required to have ratings from two of the three credit rating agencies.

“The agencies look at various things differently, but generally come to the same conclusions,” he added.

Standard & Poor affirmed their “stable” rating for Peralta in August. Moody’s affirmed Peralta’s “stable” rating in May 2023.

Bonds are a form of loan that institutions can take out from a private source, paying back the value with interest over a set number of years. All PCCD bonds are “general obligation” bonds, which are “bonds issued by a state or local government that are payable from either an issuer’s general fund or specific taxes (usually property tax),” according to the US Securities and Exchange Commission.

The Fitch report states that the bond ratings could be downgraded in the future, if they observe an inability to control spending, stalled enrollment, and/or consistent management turnover.